Changes in the remuneration system starting in financial year 2017/18

Short-term performance-based remuneration (Short-term incentive)

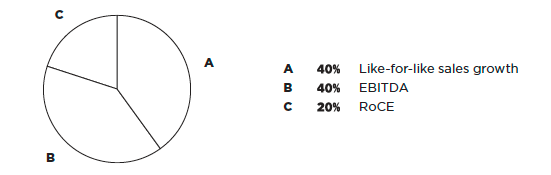

Starting in financial year 2017/18, the financial performance targets of the members of the Management Board are based on the following parameters of the group while maintaining the system of the short-term incentive:

- like-for-like sales development (sales growth in local currency on a comparable area or with respect to a comparable group of locations or merchandising concepts such as delivery and online business) at 40%

- exchange-rate adjusted earnings before deduction of interest, taxes, depreciation/amortisation/impairment losses/reversals of impairment losses on property, plant and equipment, intangible assets and investment property (EBITDA) at 40%

- exchange-rate adjusted return on capital employed (RoCE) at 20%

Parameters of the short-term incentive

A target value in € is set for each member of the Management Board. The payout amount is calculated by multiplying the target value by the factor of overall goal achievement. This, in turn, is calculated by determining the goal achievement factors for each of the financial performance targets. The weighted arithmetic mean of the factors results in the overall goal achievement factor. The overall goal achievement is limited to a factor of 2.0.

In general, performance targets are set by the Supervisory Board for each of the 3 parameters before the beginning of the financial year. The basis for determining the goals is the budget plan, which requires the approval of the Supervisory Board. To determine whether a goal has been achieved, the Supervisory Board defines a lower threshold/barrier of entry for each performance target and a target value for 100% goal achievement. A factor is allocated to the specific degree of goal achievement for each performance target:

- If the degree of goal achievement is 100%, the factor is 1.0.

- If the degree of goal achievement is lower or equal to the barrier of entry, then the factor is 0.0.

- In the case of intermediate values and values over 100%, the factor for goal achievement is calculated using linear interpolation and/or extrapolation.

To determine whether an EBITDA goal has been achieved, the Supervisory Board is authorised to adjust the EBITDA for any possible impairment losses on goodwill.

To ensure the individual performance orientation of Management Board remuneration, the Supervisory Board of METRO AG reserves the general right to reduce or increase the weight of the individual short-term incentive by up to 30%. The basis for this are goals that were agreed individually with the respective members of the Management Board as well as overlapping strategic goals for all members of the Management Board, such as customer satisfaction, employee satisfaction and sustainability.

The payout amount is limited to a maximum of 200% of the individually determined target value (payout cap).

In addition, the Supervisory Board may grant special bonuses to members of the Management Board for exceptional performance.

The short-term incentive of the members of the Management Board is payable 4 months after the end of the financial year, but not before approval of the annual and consolidated financial statements for the incentivised financial year.