Financial management

Principles and objectives of financial activities

Our financial management ensures the long-term liquidity of the company, reduces financial risks where economically feasible and grants loans to group companies. METRO AG centrally performs and monitors these activities for the group. The objective is to ensure that group companies can cover their funding requirements in a cost-efficient manner and, where possible, via the international capital markets. This applies to operating activities as well as to investments. As a matter of principle, METRO AG bases its selection of financial products on the maturities of the underlying transactions.

Intra-group cash pooling allows the surplus liquidity of individual group companies to be used for providing internal finance to other group companies. This reduces the group’s amount of debt and thus its interest expenses. METRO’s financial activities are based on a financial budget for the group, which covers all relevant companies.

METRO AG’s current long-term investment grade rating of BBB- and short-term rating of A-3 by Standard & Poor’s both ensure access to international financial and capital markets. We are utilising this access within the scope of our commercial paper programme as well as our ongoing capital market programme as required.

We support our access to the capital markets by engaging in regular dialogue with credit investors and analysts. Our Creditor Relations Team presents our company to all key European financial markets during its annual roadshow. Moreover, credit investors and analysts can learn about METRO’s impressive capabilities in face-to-face meetings and on guided factory tours. The following principles apply to all group-wide financial activities:

Financial unity

METRO presents itself as a coherent financial entity in order to gain access to the most important financial instruments on the financial and capital markets at favourable conditions.

Financial scope

In our relationships with banks and other business partners in the financial arena, we consistently maintain our scope of action in order to remain independent. In the context of our banking policy, limits have been defined to ensure that the group is able to substitute one financing partner with another at any time.

Centralised financial risk management

Our financial instruments on the international money and capital markets serve the purpose of ensuring our group’s funding requirements. They also serve the purpose of hedging underlying transactions that are exposed to interest rate and currency risks. METRO’s entire portfolio of financial instruments is monitored centrally by METRO AG.

Centralised risk monitoring

Changes in financial parameters, such as interest rate or exchange rate fluctuations, can impact the funding of METRO. The associated risks are regularly quantified via scenario analyses by METRO AG. Open risk positions, such as financial instruments without an underlying business transaction, may only be incurred if approved by the Management Board of METRO AG.

Approved business partners

For financial instruments, only contractual partners that have been approved by METRO AG are considered. The creditworthiness of these business partners is assessed on a daily basis by tracking their ratings and monitoring their credit risk ratios (essentially credit default swap analyses). This also provides the basis for the continual monitoring of compliance with the approved limits by the Treasury Controlling unit of METRO AG.

Mandatory approval

As a matter of principle, all transactions involving financial instruments that are conducted by any group company are contractually conducted by METRO AG. In cases where this is not possible for legal reasons, these transactions are concluded on behalf of the group company or directly between the group company and an external contractual partner in coordination with METRO AG.

Audit security

Our company employs the 4-eyes principle. All processes and responsibilities are laid down in group-wide guidelines. The conclusion of transactions involving financial instruments is separated from settlement and controlling in organisational terms.

- For more information about the risks stemming from financial instruments and hedging relationships, see the notes to the consolidated financial statements in no. 43 – management of financial risks.

Rating

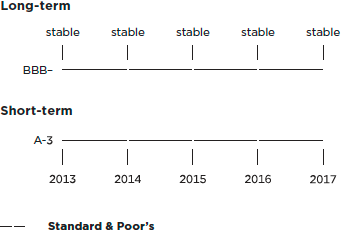

Ratings provide a standardised evaluation of a company’s ability to meet its financial obligations. They document the current creditworthiness of the company to its contractual partners independently and publicly. In addition, ratings can facilitate access to international finance and capital markets and, in turn, the utilisation of the main financial instruments. METRO AG has instructed Standard & Poor’s to assess and monitor its credit rating.

Rating development and outlook

Standard & Poor’s current assessment of METRO’s credit rating is as follows:

Category |

|

2017 |

Long-term |

|

BBB– |

Short-term |

|

A-3 |

Outlook |

|

stable |

These ratings mean that METRO currently has full access to all financial markets.

Financing measures

The company’s medium-term and long-term financing needs are covered by an ongoing capital market bond programme with a maximum volume of €6 billion. On 22 February 2017, the remaining due amount of a maturing bond in the amount of approximately €622 million with a coupon of 4.25% and on 27 July 2017, a maturing bond of €50 million with variable interest were repaid on time. By 30 September 2017, €2.451 billion had been utilised from the ongoing bond issuance programme.

Short-term financing requirements are covered through the Euro Commercial Paper Programme and a commercial paper programme geared especially to French investors. Both programmes have a maximum volume of €2 billion each. The Commercial Paper Programme aimed at French investors was not extended due to lower demand. In financial year 2016/17, only the Euro Commercial Paper Programme was used. On average, the programme was used at €658 million during the reporting period. As of 30 September 2017, the utilisation amounted to €754 million (unused as of 30 September 2016).

Bilateral credit facilities totalling €281 million were used as of 30 September 2017. As a cash reserve, 2 syndicated credit facilities worth €1,750 million and additional multi-year credit facilities worth €250 million were concluded. They were not used at any stage. After the demerger was registered, this cash reserve was adjusted to the volume that will be required in the future.

- For more information about financing programmes and credit facilities, see the notes to the consolidated financial statements in no. 36 – financial liabilities.

Aside from the established issuance programmes, the group thus had access to sufficient liquidity at all times. The undrawn credit facilities are shown in note 36 financial liabilities.