The remuneration system for members of the Management Board

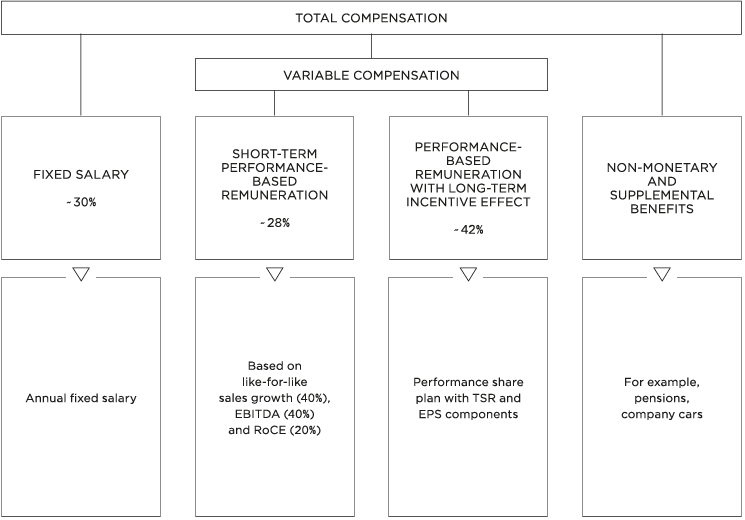

The agreed remuneration of the members of the Management Board is composed of

- a fixed salary,

- a short-term performance-based remuneration,

- a performance-based remuneration with long-term incentive effect,

- a post-employment benefits plan as well as

- other non-monetary and supplemental benefits.

The remuneration system for members of the Management Board

Schematic diagram – percentage of the target values of fixed and variable remuneration. The percentage distribution may occasionally be subject to slight differences.

Total remuneration and the individual remuneration components are geared appropriately to the responsibilities of each individual member of the Management Board, his or her personal performance and the company’s economic situation and fulfil legal stipulations regarding customary remuneration. The performance-based variable remuneration serves as an incentive for the Management Board to increase the company’s value and is designed to generate sustainable, long-term corporate development.

According to the recommendation of the German Corporate Governance Code, the remuneration for each member of the Management Board is limited in individual amounts; in each case with regard to the individual remuneration components and also in total (total disbursement cap). The upper threshold of remuneration for financial year 2017/18 amounts to €8,034,800 for Mr Koch, €4,048,600 for Mr Baier and €6,043,600 for Mr Hutmacher. For Mr Palazzi, who was appointed as a member of the Management Board with effect from 7 May 2018, the maximum amount of the remuneration granted for financial year 2017/18 amounts to €4,228,600; for Mr Boone, whose employment contract ended with effect from the end of 31 May 2018, it amounted to €6,043,600.

Insofar as a member of the Management Board negligently or intentionally violates his or her duties and the company incurs damage as a result of it, the Supervisory Board has the right to withhold payment of the remuneration of this member of the Management Board in full or in part. A so-called clawback clause (repayment agreement), which in the event of a negative development provides for the recovery of payments made in the past from variable remuneration components, was not agreed with the members of the Management Board, since payments from the short-term performance-based remuneration and the performance-based remuneration with a long-term incentive effect only take place after fulfilment of the performance targets and termination of the performance period. Without prejudice to this, a reduction of future payments to be paid in the event of a deterioration of the company’ssituation according to § 87 Section 2 of the German Stock Corporation Act (AktG) remains.

Fixed salary

The fixed salary is contractually set and is paid in monthly instalments.

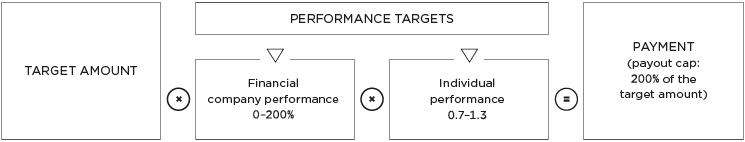

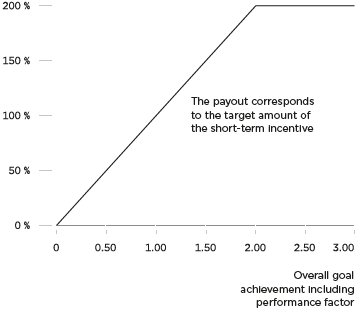

Short-term performance-based remuneration (short-term incentive, STI)

The short-term incentive remunerates the company’s operating performance on the basis of financial performance targets pertaining to that specific financial year.

A target value in euros is set for each member of the Management Board. The payout amount is calculated by multiplying the target value by the factor of overall target achievement. This, in turn, is calculated by determining the target achievement factors for each of the financial performance targets. The weighted arithmetic mean of the individual factors results in the overall target achievement factor. The overall target achievement is limited to a factor of 2.0.

Short-term incentive

Schematic diagram.

The short-term incentive for financial year 2017/18 is based on the following parameters of the group:

- like-for-like sales development (sales growth in local currency on a comparable area or with respect to a comparable group of locations or merchandising concepts such as delivery and online business) at 40%,

- exchange rate-adjusted earnings before interest expenses, taxes, depreciation and amortisation (EBITDA) at 40%,

- exchange rate-adjusted return on capital employed (RoCE) at 20%,

in each case based on the target amount.

In general, performance targets are set by the Supervisory Board for each of the 3 parameters before the beginning of the financial year. The basis for determining the targets is the budget plan, which requires the approval of the Supervisory Board. To determine whether a target has been achieved, the Supervisory Board defines a lower threshold/entrance hurdle for each performance target and a target value for 100% target achievement. A factor is allocated to the specific degree of target achievement for each performance target:

- If the degree of target achievement is 100%, the factor is 1.0.

- If the degree of target achievement is lower or equal to the entrance hurdle, then the factor is 0.0.

- In the case of intermediate values and values over 100%, the factor for target achievement is calculated using linear interpolation and/or extrapolation.

To determine whether an EBITDA target has been achieved, the Supervisory Board is authorised to adjust the EBITDA for any possible impairment losses on goodwill.

To ensure the individual performance orientation of Management Board remuneration, the Supervisory Board reserves the general right to reduce or increase the weight of the individual short-term incentive by up to 30%. The basis for this are targets that were agreed individually with the respective members of the Management Board as well as overlapping strategic targets for all members of the Management Board, such as customer satisfaction, employee satisfaction and sustainability.

Short-term incentive – disbursement calculation

The payout amount of the short-term incentive is limited to a maximum of 200% of the individually determined target value (payout cap).

In addition, the Supervisory Board may grant special bonuses to members of the Management Board for exceptional performance. In the reporting year, no special bonuses were granted to the members of the Management Board.

The short-term incentive of the members of the Management Board is payable 4 months after the end of the financial year, but not before approval of the annual and consolidated financial statements by the Supervisory Board for the incentivised financial year.

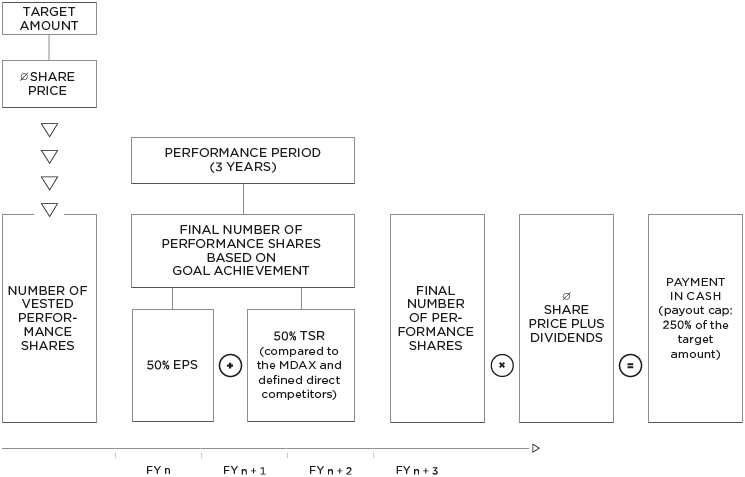

Performance-based remuneration with long-term incentive effect (long-term incentive, LTI)

The performance-based remuneration with long-term incentive effect incentivises the company’s long-term and sustainable corporate development, taking into account the internal and external value development as well as the concerns of the shareholders and the other stakeholders associated with the company.

Performance share plan (since financial year 2016/17)

The annual tranches of the so-called performance share plan and their associated performance targets generally have a multi-year assessment basis. The performance period is in general 3 years. The payout amount is limited to a maximum of 250% of the individually determined target value (payout cap). In case of employment termination of a member of the Management Board before the end of a performance period, separate rules for the payout of the tranches have been agreed upon.

Each member of the Management Board is initially allocated conditional performance shares, the amount of which corresponds to the quotient of the individual target amount and the arithmetic mean of the share price of the company’s ordinary share upon allocation. The decisive factor here are the average Xetra closing prices of the company’s ordinary share over a period of 40 consecutive stock exchange trading days immediately after the Annual General Meeting of the company in the year of the allocation. An exception to this is the granted 2016/17 tranche of the performance share plan, which is based on the average closing prices of 40 consecutive stock exchange trading days beginning on 13 July 2017, the initial listing date of the share.

The performance period ends after the 40th stock exchange trading day following the ordinary Annual General Meeting of the third financial year following the issuance of the tranche. After the end of the performance period of a tranche, the final number of performance shares is determined, which depends on the achievement of 2 performance targets, which are weighted equally in the target amount of the performance share plan:

- Reported earnings per share (EPS),

- Total shareholder return (TSR).

Long-term Incentive

Schematic diagram.

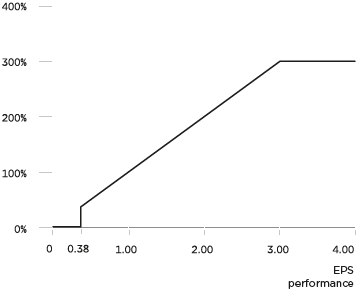

For the EPS component, the Supervisory Board generally decides at the beginning of the financial year in which the tranche of the performance share plan is allocated on a lower threshold/entrance hurdle for target achievement and an EPS target value for 100% target performance for the third financial year of the performance period. A factor is allocated to the specific degree of target achievement:

- If the degree of target achievement at the end of the performance period is 100%, the factor is 1.0.

- If the degree of target achievement is lower or equal to the entrance hurdle, then the factor is 0.0. For the tranche granted in financial year 2017/18, the entrance hurdle amounts to 38% of the target achievement.

- In the case of intermediate values and values over 100% up to a maximum of 300%, the factor for target achievement is calculated using linear interpolation and/or extrapolation.

Determining the goal achievement of the EPS component

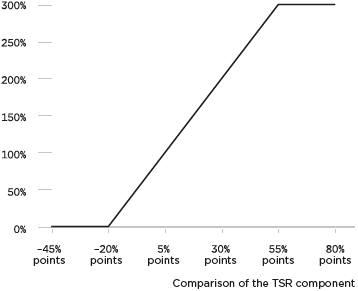

The target achievement factor of the TSR component is measured by the development of the total shareholder return of the company’s ordinary share in the performance period relative to a defined benchmark index and to a defined comparison group, in example the comparison is evenly splitt betweenthe development of the MDAX TSR and the development of the average TSR of a defined comparison group of direct competitors over the same period as the TSR of the company. The TSR value of the comparison group of the direct competitors is determined individually for the members of the comparison group and then the arithmetic mean is established. The comparison group of direct competitors consists of the following companies: Bidcorp, Bizim Toptan, Marr, Eurocash Group, Performance Food Group, US Foods, Sysco and Sligro. Only companies that are listed for the entire performance period are included in this group. If TSR values are available for fewer than 6 companies in this comparison group, then the METRO TSR will be exclusively compared with the MDAX TSR – and the comparison with the group of direct competitors will not apply.

For the TSR component, the Supervisory Board also usually establishes a lower threshold/entrance hurdle and a TSR target value for the 100% target achievement at the beginning of the financial year in which the tranche of the performance share plan is granted.

To determine the target achievement, the Xetra closing prices of the company’s ordinary share are determined over a period of 40 consecutive stock exchange trading days immediately after the Annual General Meeting of the company in the year of the allocation of the tranche. This is used to establish the arithmetic mean, as the so-called starting share price. The performance period for the respective tranche will begin on the fourty-first stock exchange trading day following the Annual General Meeting, or for the tranche granted in financial year 2016/17 on the 41st stock exchange trading day following the initial listing of the ordinary share of the company. 3 years after the starting share price has been determined and the tranche has been issued, the Xetra closing prices of the ordinary share of the company will be determined over a period of 40 consecutive stock exchange trading days immediately following the Annual General Meeting. This is used again to establish the arithmetic mean, the so-called ending share price. The TSR value is determined as a percentage on the basis of the change in the company’s ordinary share price and the total amount of hypothetically reinvested dividends throughout the performance period in relation to the starting share prices.

The resulting TSR of the company is compared to the equally determined TSR of the 2 comparison groups in the performance period. A factor is allocated to the specific degree of target achievement:

- If the degree of target achievement at the end of the performance period is 100%, the factor is 1.0. This requires an outperformance of 5% versus the comparison group.

- If the degree of target achievement is lower or equal to the barrier of entry, then the factor is 0.0.

- In the case of intermediate values and values over 100% up to a maximum of 300%, the factor for goal achievement is calculated using linear interpolation and/or extrapolation.

Determining the goal achievement of the TSR component

The target achievement factors of the EPS and TSR components are used to form the arithmetic mean that establishes the overall target achievement factor. This is used to determine the target number of performance shares, which results in a cash payment in euros at the end of the performance period of the tranche:

- If the total target achievement factor for both components is 1.0, then the target number of performance shares equals the number of conditionally allocated performance shares.

- If the total target achievement factor is 0.0, then the number of performance shares decreases to zero.

- For all other target achievements, the target number of performance shares is determined by means of linear interpolation or extrapolation.

The target number of performance shares is limited to a maximum of 300% of the conditionally allocated number of performance shares.

The payout amount is calculated per performance share as follows: 3 years after the starting share price has been determined and the tranche has been issued, the Xetra closing prices of the ordinary share of the company will be determined over a period of 40 consecutive stock exchange trading days immediately following the Annual General Meeting. The arithmetic mean is formed from this and all the dividends paid during the performance period for the ordinary share of the company are added to it. This so-called share factor is multiplied by the number of calculated performance shares and establishes the gross payout amount.

The payout amount is limited to a maximum of 250% of the individually determined target value (payout cap).

The tranches of the performance share plan will be paid no later than 4 months after the Annual General Meeting that decides on the appropriation of the balance sheet profit of the last financial year of the performance period, but not before the approval of all annual and consolidated financial statements for the financial years of the performance period by the Supervisory Board.

Share ownership guidelines

METRO introduced share ownership guidelines along with its performance share plan: As a prerequisite for the cash payment of performance shares, the members of the Management Board are obligated for each tranche to develop a self-financed investment in ordinary shares of the company by the end of February in the third year of the performance period. The amount to be invested per tranche for the Chairman of the Management Board is two thirds of his or her gross annual fixed salary and for an ordinary member of the Management Board 50% of his or her gross annual fixed salary. The plan aims to ensure that, after no more than 5 years of service, the Chairman of the Management Board has invested 200% and an ordinarymember of the Management Board 150% of his or her gross fixed salary in ordinary shares of the company, based on the calculated purchase price for the respective shares. The key factor for calculating the purchase price and thus the number of ordinary shares to be acquired is the average price of the Xetra closing prices of the company’s ordinary share over the 40 consecutive stock exchange trading days immediately after the annual press conference which takes place before February in the third year of the performance period. The purchase price corresponds to the quotient of the amount to be invested, which results from the gross annual fixed salary and the determined average price. If the personal investment to be made in ordinary shares of the company is not, or not fully, met on the relevant closing date, the payout amount will initially be paid out in cash, but with the obligation to invest it in ordinary shares of the company until the share ownership guidelines are met.

Transfer of long-term incentives in connection with the demerger

Irrespective of the performance share plan, the members of the Management Board were granted 2 long-term incentive tranches in financial year 2016/17. Of the 2014/15 and 2015/16 tranches of the sustainable performance plan version 2014, which were granted by the former METRO AG (now: CECONOMY AG) prior to the demerger, the remaining target amounts for the period from the day after the demerger took effect on 13 July 2017 until the end of the performance period were transferred to today’s METRO AG. The target achievement of the former 2014/15 tranche was linked to the parameter return on capital employed (RoCE) before special items related to financial year 2016/17 and the target achievement of the former 2015/16 tranche in the earnings per share (EPS) parameter for financial year 2017/18. In order to determine the target achievement, the Supervisory Board set thresholds for both tranches: a lower threshold/entrance hurdle and a target value for target achievement of 100%. The target achievement of the respective tranche is used to determine the factor which, multiplied by the individual target amount, results in a cash payment in euros at the end of the performance period of the tranche:

- If the degree of target achievement at the end of the performance period is 100%, the factor is 1.0.

- If the degree of target achievement is lower or equal to the entrance hurdle, then the factor is 0.0.

- In the case of intermediate values and values over 100%, the factor for target achievement is calculated using linear interpolation and/or extrapolation.

The payout amount is limited to a maximum of 250% of the determined individual target value (payout cap).

The performance period of the tranche linked to the RoCE performance target ended after the 40th stock exchange trading day after the Annual General Meeting of the company in 2018. The performance period of the tranche linked to the EPS performance target has been reduced from the original 4-year term to 3 years and ends after the 40th stock exchange trading day after the Annual General Meeting of the company in 2019.

Post-employment benefits plans

As members of the Management Board, Mr Koch, Mr Baier and Mr Hutmacher receive post-employment benefits plans in the form of employer’s commitments. This form of commitment also existed for Mr Boone until 31 May 2018. The financing is provided jointly by the Management Board and the company. This is based on an apportionment of ‘7 +14’. When a member of the Management Board makes a contribution of 7% of his or her defined basis for assessment, the company will contribute twice the amount. The assessment is based on the amount of the fixed salary and the target amount of the short-term incentive. When a member of the Management Board leaves the company before the benefit case occures, the contributions retain the level they have reached. This component of post-employment benefits plans is congruently reinsured by Hamburger Pensionsrückdeckungskasse VVaG (HPR). The interest rate for the contributions is paid in accordance with the Articles of Association of the HPR with regard to profit participation, with a guarantee applying to the paid-in contribution.

Entitlement to pension plans exists

- if employment ends with or after reaching the statutory retirement age in the German statutory pension insurance,

- if employment ends after the age of 60 or after the age of 62 for pension commitments granted after 31 December 2011 and before reaching the regular retirement age,

- in the event of disability or death, provided that the relevant conditions of eligibility are met.

Payment can be made in the form of a one-time capital payment, instalments or a life-long pension. A minimum benefit is granted in the case of invalidity or death. In such instances, the total amount of contributions that would have been credited to the member of the Management Board for every calendar year up to a credit period of 10 years, but limited to the point when the individual turns 60, will be added to the benefits balance. This component of post-employment benefits plans is not reinsured and will be provided directly by the company when the benefit case occurs.

Mr Palazzi will receive the corporate contribution in the form of an earmarked one-off payment at the end of a financial year for setting up a pension plan at his discretion, without the need for a personal contribution.

Furthermore, members of the Management Board have been given the option of converting future compensation components in the fixed salary as well as in the variable remuneration into post-employment benefits plans with Hamburger Pensionsrückdeckungskasse VVaG as part of a tax-privileged deferred compensation scheme.

The members of the Management Board have no further pension commitments beyond the described retirement benefits. In particular, no retirement payments will be granted.

Further benefits in case of an end to employment

Severance payments in cases of premature terminations of management roles without good cause are limited to 2 annual remunerations (severance cap) and must not exceed the remuneration that would be paid for the remaining term of the employment contract. The recommendation by the German Corporate Governance Code is complied with.

In the event of a change of control, the members of the Management Board may exercise their right to resign from their office for good cause, within 6 months after the change of control as to the end of each month by giving 3 months prior notice. They may also terminate their employment contract with effect to this date (extraordinary termination right).

The contractual provisions assume a change of control if either a single shareholder or a number of jointly acting shareholders have acquired a controlling interest in the meaning of § 29 of the German Securities Acquisition and Takeover Act (WpÜG) by way of holding at least 30% of the voting rights and the change of control significantly interferes with the postion of a member of the Management Board.

If the extraordinary termination right is exercised, or if the employment contract is terminated on the basis of an amicable agreement within 6 months from the change of control, the respective member of the Management Board shall be entitled to the payout of his or her contractual entitlements for the remaining term of the member’s employment contract in form of a lump sum compensation. The recommendation by the German Corporate Governance Code is complied with and the amount of the severance payment is being limited to 150% of the severance payment cap. The entitlement to a severance payment lapses, if the employment was terminated by the company by extraordinary notice for dismissal for good cause pursuant to § 626 of the German Civil Code (BGB).

In addition, the employment contracts of the members of the Management Board generally provide for a post-contractual restraint on competition. They are prohibited from providing services to or for a competitor for a period of 12 months after termination of the employment contract. For this purpose, compensation for non-competition has been agreed which corresponds to the target salary consisting of the fixed salary, short-term incentive and long-term incentive for the duration of the post-contractual restraint on competition and is paid in monthly instalments. These payments will be credited with compensation earned by any other use of the workforce. The company has the option of waiving the post-contractual restraint on competition prior to or upon termination of the employment contract, while observing cancellation periods.

In the event of the death of a member of the Management Board during active service, his or her surviving dependants will be paid the fixed salary for the month in which the death occurred as well as for an additional 6 months.

Other non-monetary and supplemental benefits

The supplemental benefits granted to members of the Management Board include non-cash benefits from benefits in kind, such as company cars.

Remuneration of the Management Board in financial year 2017/18

The remuneration of the members of the Management Board in financial year 2017/18 pursuant to the German Commercial Code as well as in accordance with the tables provided by the German Corporate Governance Code is as follows:

|

|

|

|

|

|

|

|

|

|

Performance-based remuneration with long-term incentive effect |

|

|

|

|

|||||||||||||||||

€1,000 |

|

Financial year |

|

Fixed salary |

|

Supplemental benefits |

|

Short-term performance- |

|

Value of granted tranches6 |

(Payment from tranches granted in the past) |

|

Total7 |

|

(Effective salary8) |

||||||||||||||||

|

|||||||||||||||||||||||||||||||

Olaf Koch2 |

|

2016/17 |

|

261 |

|

4 |

|

323 |

|

1,303 |

(0) |

|

1,891 |

|

(588) |

||||||||||||||||

|

2017/18 |

|

1,200 |

|

20 |

|

177 |

|

1,214 |

(884) |

|

2,611 |

|

(2,281) |

|||||||||||||||||

Christian Baier3 |

|

2016/17 |

|

406 |

|

7 |

|

334 |

|

660 |

(0) |

|

1,407 |

|

(747) |

||||||||||||||||

|

2017/18 |

|

700 |

|

18 |

|

88 |

|

585 |

(91) |

|

1,391 |

|

(897) |

|||||||||||||||||

Pieter C. Boone4 |

|

2016/17 |

|

196 |

|

4 |

|

220 |

|

782 |

(0) |

|

1,202 |

|

(420) |

||||||||||||||||

|

2017/18 |

|

600 |

|

12 |

|

0 |

|

– |

(91) |

|

612 |

|

(703) |

|||||||||||||||||

Heiko Hutmacher2 |

|

2016/17 |

|

196 |

|

4 |

|

220 |

|

977 |

(0) |

|

1,397 |

|

(420) |

||||||||||||||||

|

2017/18 |

|

900 |

|

17 |

|

134 |

|

910 |

(663) |

|

1,961 |

|

(1,714) |

|||||||||||||||||

Philippe Palazzi5 |

|

2016/17 |

|

– |

|

– |

|

– |

|

– |

– |

|

– |

|

– |

||||||||||||||||

|

2017/18 |

|

280 |

|

126 |

|

34 |

|

– |

– |

|

440 |

|

(440) |

|||||||||||||||||

Total |

|

2016/17 |

|

1,059 |

|

19 |

|

1,097 |

|

3,722 |

(0) |

|

5,897 |

|

(2,175) |

||||||||||||||||

|

2017/18 |

|

3,680 |

|

193 |

|

433 |

|

2,709 |

(1,729) |

|

7,015 |

|

(6,035) |

|||||||||||||||||

|

|

Olaf Koch1 |

|

Christian Baier2 |

||||||||||||||||

|

|

Chairman of the Management Board |

|

Chief Financial Officer |

||||||||||||||||

|

|

2016/17 |

2017/18 |

2017/18 |

2017/18 |

|

2016/17 |

2017/18 |

2017/18 |

2017/18 |

||||||||||

€1,000 |

|

|

|

Minimum value |

Maximum value |

|

|

|

Minimum value |

Maximum value |

||||||||||

|

||||||||||||||||||||

Fixed salary |

|

261 |

1,200 |

1,200 |

1,200 |

|

406 |

700 |

700 |

700 |

||||||||||

Supplemental benefits |

|

4 |

20 |

20 |

70 |

|

7 |

18 |

18 |

70 |

||||||||||

Total |

|

265 |

1,220 |

1,220 |

1,270 |

|

413 |

718 |

718 |

770 |

||||||||||

1-year variable remuneration |

|

244 |

1,120 |

0 |

2,240 |

|

314 |

540 |

0 |

1,080 |

||||||||||

Multi-year variable remuneration |

|

|

|

|

|

|

|

|

|

|

||||||||||

Transferred LTI with performance target RoCE (allocation 13/7/2017, end of performance period after the 40th trading day following the Annual General Meeting 2018) |

|

413 |

– |

– |

– |

|

43 |

– |

– |

– |

||||||||||

Transferred LTI with performance target EPS (allocation 13/7/2017, end of performance period after the 40th trading day following the Annual General Meeting 2019) |

|

1,108 |

– |

– |

– |

|

381 |

– |

– |

– |

||||||||||

Performance share plan – tranche 2016/175 (allocation 7/9/2017, end of performance period after the 40th trading day following the Annual General Meeting 3 years after the issuance of the tranche) |

|

1,303 |

– |

– |

– |

|

660 |

– |

– |

– |

||||||||||

Performance share plan – tranche 2017/185 (allocation 18/4/2018, end of performance period after the 40th trading day following the Annual General Meeting 3 years after the issuance of the tranche) |

|

– |

1,214 |

0 |

4,200 |

|

– |

585 |

0 |

2,025 |

||||||||||

Total |

|

3,333 |

3,554 |

1,220 |

7,710 |

|

1,811 |

1,843 |

718 |

3,875 |

||||||||||

Pension expenditure |

|

71 |

325 |

325 |

325 |

|

101 |

174 |

174 |

174 |

||||||||||

Total remuneration |

|

3,404 |

3,879 |

1,545 |

8,035 |

|

1,912 |

2,017 |

892 |

4,049 |

||||||||||

XLS

|

|

Pieter C. Boone3 |

|

Heiko Hutmacher1 |

|

Philippe Palazzi4 |

|||||||||||||||||||

|

|

Chief Operating Officer |

|

Chief Human Resources Officer and Labour Director |

|

Chief Operating Officer |

|||||||||||||||||||

|

|

2016/17 |

2017/18 |

2017/18 |

2017/18 |

|

2016/17 |

2017/18 |

2017/18 |

2017/18 |

|

2016/17 |

2017/18 |

2017/18 |

2017/18 |

||||||||||

€1,000 |

|

|

|

Minimum value |

Maximum value |

|

|

|

Minimum value |

Maximum value |

|

|

|

Minimum value |

Maximum value |

||||||||||

|

|||||||||||||||||||||||||

Fixed salary |

|

196 |

600 |

600 |

600 |

|

196 |

900 |

900 |

900 |

|

– |

280 |

280 |

280 |

||||||||||

Supplemental benefits |

|

4 |

12 |

12 |

47 |

|

4 |

17 |

17 |

70 |

|

– |

126 |

126 |

170 |

||||||||||

Total |

|

200 |

612 |

612 |

647 |

|

200 |

917 |

917 |

970 |

|

– |

406 |

406 |

450 |

||||||||||

1-year variable remuneration |

|

183 |

560 |

0 |

1,120 |

|

183 |

840 |

0 |

1,680 |

|

– |

216 |

0 |

432 |

||||||||||

Multi-year variable remuneration |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Transferred LTI with performance target RoCE (allocation 13/7/2017, end of performance period after the 40th trading day following the Annual General Meeting 2018) |

|

43 |

– |

– |

– |

|

310 |

– |

– |

– |

|

– |

– |

– |

– |

||||||||||

Transferred LTI with performance target EPS (allocation 13/7/2017, end of performance period after the 40th trading day following the Annual General Meeting 2019) |

|

665 |

– |

– |

– |

|

831 |

– |

– |

– |

|

– |

– |

– |

– |

||||||||||

Performance share plan – tranche 2016/175 (allocation 7/9/2017, end of performance period after the 40th trading day following the Annual General Meeting 3 years after the issuance of the tranche) |

|

782 |

– |

– |

– |

|

977 |

– |

– |

– |

|

– |

– |

– |

– |

||||||||||

Performance share plan – tranche 2017/185 (allocation 18/4/2018, end of performance period after the 40th trading day following the Annual General Meeting 3 years after the issuance of the tranche) |

|

– |

– |

– |

– |

|

– |

910 |

0 |

3,150 |

|

– |

– |

– |

– |

||||||||||

Total |

|

1,873 |

1,172 |

612 |

1,767 |

|

2,501 |

2,667 |

917 |

5,800 |

|

– |

622 |

406 |

882 |

||||||||||

Pension expenditure |

|

55 |

165 |

165 |

165 |

|

53 |

244 |

244 |

244 |

|

– |

– |

– |

– |

||||||||||

Total remuneration |

|

1,928 |

1,337 |

777 |

1,932 |

|

2,554 |

2,911 |

1,161 |

6,044 |

|

– |

622 |

406 |

882 |

||||||||||

|

|

Olaf Koch1 |

|

Christian Baier2 |

|

Pieter C. Boone3 |

|

Heiko Hutmacher1 |

|

Philippe Palazzi4 |

|||||||||||||

|

|

Chairman of the Management Board |

|

Chief Financial Officer |

|

Chief Operating Officer |

|

Chief Human Resources Officer and Labour Director |

|

Chief Operating Officer |

|||||||||||||

€1,000 |

|

2017/18 |

2016/17 |

|

2017/18 |

2016/17 |

|

2017/18 |

2016/17 |

|

2017/18 |

2016/17 |

|

2017/18 |

2016/17 |

||||||||

|

|||||||||||||||||||||||

Fixed remuneration |

|

1,200 |

261 |

|

700 |

406 |

|

600 |

196 |

|

900 |

196 |

|

280 |

– |

||||||||

Supplemental benefits |

|

20 |

4 |

|

18 |

7 |

|

12 |

4 |

|

17 |

4 |

|

126 |

– |

||||||||

Total |

|

1,220 |

265 |

|

718 |

413 |

|

612 |

200 |

|

917 |

200 |

|

406 |

– |

||||||||

1-year variable remuneration |

|

177 |

323 |

|

88 |

334 |

|

0 |

220 |

|

134 |

220 |

|

34 |

– |

||||||||

Multi-year variable remuneration |

|

884 |

0 |

|

91 |

0 |

|

91 |

0 |

|

663 |

0 |

|

0 |

– |

||||||||

Other |

|

0 |

0 |

|

0 |

0 |

|

0 |

0 |

|

0 |

0 |

|

0 |

– |

||||||||

Total |

|

2,281 |

588 |

|

897 |

747 |

|

703 |

420 |

|

1,714 |

420 |

|

440 |

– |

||||||||

Pension expenditure |

|

325 |

71 |

|

174 |

101 |

|

165 |

55 |

|

244 |

53 |

|

– |

– |

||||||||

Total remuneration |

|

2,606 |

659 |

|

1,071 |

848 |

|

868 |

475 |

|

1,958 |

473 |

|

440 |

– |

||||||||

Long-term incentive (performance share plan) in financial year 2017/18

For the tranche of the performance share plan granted in financial year 2017/18, the target amount for Mr Koch is €1.68 million, for Mr Baier €0.81 million and for Mr Hutmacher €1.26 million. Mr Boone and Mr Palazzi were not allocated a tranche of the performance share plan during the reporting period.

The number of (initially vested) allocated performance shares amounts to 111,259 for Mr Koch, 53,643 for Mr Baier and 83,444 for Mr Hutmacher.

The value of the tranche distributed in financial year 2017/18 as part of the performance share plan was calculated at the time of granting by external experts using recognised financial-mathematical methods.

Tranche |

|

End of the performance period |

|

Starting price for the TSR component |

|

Target amount Management Board as of 30/9/2018 |

2016/17 |

|

after the 40th trading day following the Annual General Meeting 3 years after the issuance of the tranche |

|

€17.14 |

|

€3,610,000 |

2017/18 |

|

after the 40th trading day following the Annual General Meeting 3 years after the issuance of the tranche |

|

€15.10 |

|

€3,750,000 |

In addition to the tranche from the performance share plan issued, in the reporting period the members of the Management Board active in financial year 2017/18 have access to tranches of the long-term incentive that were granted in the past: Mr Koch, Mr Baier and Mr Hutmacher have access to the 2016/17 tranche of the performance share plan and the transferred LTI tranche, which is linked to the EPS performance target. Mr Palazzi has a commitment to the METRO Cash & Carry LTI from the time he worked for METRO prior to his appointment as a member of the Management Board. Mr Boone no longer has any claims from tranches of the long-term incentive granted to him in the past.

The performance period of the transferred LTI tranche, which was linked to the RoCE performance target, ended 40 stock exchange trading days after the Annual General Meeting 2018. Based on the determined target achievement, the following amounts were paid out for this tranche: Mr Koch €0.884 million, Mr Baier €0.091 million, Mr Boone €0.091 million and Mr Hutmacher €0.663 million.

In financial year 2017/18, value adjustments resulted from the current share-based tranches of performance-based remuneration programmes with a long-term incentive effect. The company’s expenses amounted to €0.12 million for Mr Koch, €0.06 million for Mr Baier, €0.03 million for Mr Boone, €0.09 million for Mr Hutmacher, and €0.45 million for Mr Palazzi.

As of 30 September 2018, the provisions for the members of the Management Board totalled €1.79 million.

Services after the end of employment in financial year 2017/18 (including provisions for post-employment benefits plans)

In financial year 2017/18, a total of €0.91 million according to International Financial Reporting Standards (IFRS) and €0.80 million according to the German Commercial Code (HGB) was used for the remuneration of the active members of the Management Board of METRO AG for benefits to be provided after the end of their employment (2016/17: €0.28 million determined according to IFRS and €0.29 million determined according to the German Commercial Code (HGB)). Of this total, according to IFRS, approximately €0.33 million accounted for pension plans for Mr Koch, approximately €0.17 million for Mr Baier, approximately €0.17 million for Mr Boone and approximately €0.24 million for Mr Hutmacher.

For post-employment benefits plans according to the German Commercial Code (HGB), approximately €0.32 million was allocated to Mr Koch, approximately €0.17 million to Mr Baier, approximately €0.07 million to Mr Boone and approximately €0.24 million to Mr Hutmacher.

Provisions according to IFRS and the German Commercial Code (HGB) amount to approximately €0.003 million each for Mr Koch and Mr Baier. There is no need to establish provisions for Mr Hutmacher.

The cash value of the commitment volume according to IFRS and German Commercial Code (HGB) amounts to approximately €3.5 million for Mr Koch, approximately €0.8 million for Mr Baier, approximately €1.6 million for Mr Boone and approximately €2.6 million for Mr Hutmacher. With the exception of the provisions listed in the last paragraph, the cash value of the commitment volume is offset by assets. There is no commitment volume for Mr Palazzi.

Termination benefits in financial year 2017/18

An agreement was reached with Mr Boone in the reporting year for the premature termination of his employment contract with effect as to the end of 31 May 2018. A severance payment in the amount of €4,693,288 was agreed to settle the remaining term of his employment contract (1 June 2018 to 30 September 2020) as well as the short-term incentive for the period from 1 October 2017 to 31 May 2018 and the tranches already granted from long-term incentives. This settlement covers Mr Boone’s claims, taking into account the contractually agreed severance payment cap in accordance with the German Corporate Governance Code and the development of performance-based remuneration components based on extrapolation. In addition, Mr Boone received a compensation for non-competition of €1.5 million for a post-contractual restraint on competition, which was agreed for the period from the termination of the employment contract until 30 November 2018.