Strategy

METRO

As a leading international specialist in the wholesale and food retail trade, METRO sees itself as a partner committed to its customers’ success and satisfaction every day. To ensure that we remain relevant to our customers and successful in the long term, we have set ourselves the goal of taking the food retail and food service sector to a new level. We will take advantage of the unique opportunities arising from the digitisation of the entire industry sector.

METRO essentially consists of the METRO Wholesale and Real segments, which are responsible for our operations. The METRO Wholesale segment comprises the METRO/MAKRO Cash & Carry wholesale stores and the delivery business. It is primarily targeting business customers (B2B). The Real segment focuses on the retail industry in Germany and thus on end consumers (B2C). Real is one of the leading hypermarket companies in Germany. Additionally, the business unit HoReCa Digital, founded in 2015, consolidates the group’s digitisation initiatives.

For us, sustainability does not stop at focusing on environmental and social issues. The notion of sustainability encompasses every single aspect of our actions and is a fixed item on the agenda of our corporate strategy.

Beyond that, more than 150,000 highly motivated employees worldwide also shape our company. They fill our open corporate culture with life and combine passion, a partnership approach and outstanding performance in our core business.

METRO Wholesale

In financial year 2016/17, our METRO Wholesale segment had more than 100,000 employees. As a multi-channel supplier, we combine a wide network of modern wholesale stores with extensive food service distribution (FSD). Our customers can choose between shopping in-store, having their purchases delivered or, in France, shopping online via click-and-collect services and picking up the goods at the market. Our wholesale business is also characterised by a strong international presence: we are active in 35 countries in Western Europe, Eastern Europe and Asia. Under the METRO and MAKRO brands, we operate a total of 759 wholesale stores in 25 countries, whereas we only offer delivery services in the remaining 10 countries. The FSD area is reinforced by dedicated delivery specialists whom we acquired in recent years, including Classic Fine Foods, Pro à Pro and Rungis Express.

Focus on customer benefits

Our goal is to improve our customers’ competitive advantage to make them more successful. Most of our wholesale customers are small and medium-sized companies and sole traders. We want to help them better master their business challenges by supplying long-term solutions with superior added economic value. We consistently align our business model with customer value and strengthen our local organisations to establish a closer relationship with our B2B customers.

We summarise our B2B customers in 3 groups: HoReCa, Trader and Service Companies and Offices (SCO). HoReCa includes hotels and hospitality businesses, restaurants, bars and cafés as well as catering companies and canteen operators. The Trader section includes small grocery stores, kiosks, street food retailers, petrol stations and wholesalers. SCO are professional service companies and organisations, such as offices and institutions.

Value leverage for the business

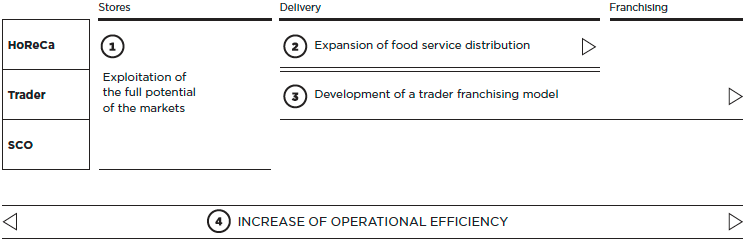

Based on our business model, our local companies develop and implement their individual Value Creation Plans that enable transformation and growth according to local conditions. The central organisation supports local value creation and actively manages the portfolio. Based on the country-specific and locally generated Value Creation Plans, we have identified 5 major strategic value enhancers for our wholesale business (see also wholesale strategy chart).

Wholesale strategy

Real

With more than 34,000 employees and 282 stores, Real is one of Germany’s leading hypermarket operators. Real stores offer a wide assortment that includes both food and several non-food product categories.

Real’s declared goal is to sustainably increase its customer relevance in the coming years. That’s why in financial year 2015/16, Real laid the foundation for a strategic realignment, which it systematically pursued and expanded in 2016/17. Real’s overall strategy includes the expansion of promising sales channels, such as the online shop and click-and-collect services, but also the comprehensive optimisation of the existing store network.

Strategic priorities

- Customer orientation: Real designs its product range and services with a greater focus on the wishes and needs of its customers. This is accompanied by the modernisation and spatial transformation of hypermarkets to increase productivity per square metre. We also continue to implement our so-called Food Lover concept. This is a new hybrid-store concept that combines the focus on customers with the benefits of large areas and addresses the specific needs of today’s and tomorrow’s retail customers. As a grocery store operator, our vision is to provide a unique shopping experience at all customer touchpoints, that is, at all possible points of contact between customer and our company.

- Selected investments: Real is making selected investments to establish itself as a multichannel retailer, strengthen its ultrafresh categories and further expand its procurement partnerships and joint ventures. In e-commerce, the Real.de website constitutes another step forward. In February 2017, we completed the integration of the previous Hitmeister online presence. Since then, the Real online marketplace has been offering customers a vast amount of items in 5,000 categories. External online retailers can also market their products there. In the e-food sector, Real has been testing the online food shop since April 2017. This also prepares the company for any potential increase in e-food demand.

- Increase in cost efficiency: We have streamlined our management structures, leveraged synergies within the group and restructured our core functions. In addition, we are restructuring our administration and consolidating functions within the group. In mid‑2016, Real and the Verdi trade union agreed on a future collective agreement. The goal is to create structures that are competitive and offer good working conditions.

- For more information, see the Annual Report 2016/17 at www.metroag.de/more/strategy.

Since financial year 2015/16, the Trader cluster comprises the METRO Cash & Carry countries Moldova, Poland, Romania and Ukraine. The HoReCa, Multispecialist and Trader clusters replace the previous reporting regions of Germany, Western Europe, Eastern Europe and Asia.