Overview of financial year 2016/17

Earnings position

- Due to positive currency and portfolio effects, reported sales for financial year 2016/17 increased by 1.6% to €37.1 billion (in local currency: +1.1%)

- Like-for-like sales at METRO climbed by 0.5% in financial year 2016/17

- Reported EBIT amounts to €852 million (2015/16: €1,219 million)

- EBIT before special items: €1,106 million (2015/16: €1,106 million) on par with the previous year

- Profit for the period before special items: €583 million (2015/16: €495 million)

- Earnings per share before special items improved to €1.55 (2015/16: €1.33)

Financial and asset position

- Net debt increased by €0.1 billion to €3.1 billion (30/9/2016: €3.1 billion)

- Investments totalled €0.8 billion (2015/16: €1.0 billion)

- Cash flow from operating activities reached €1.0 billion (2015/16: €1.2 billion)

- Total assets amounted to €15.8 billion (30/9/2016: €16.0 billion)

- Equity: €3.2 billion (30/9/2016: €2.9 billion); equity ratio: 20.3% (30/9/2016: 18.3%)

- Long-term rating: BBB– (Standard & Poor’s)

Sales and earnings development

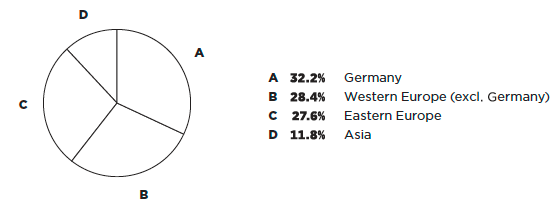

Supported by positive currency effects and the acquisition of Pro à Pro, METRO’s reported sales for financial year 2016/17 increased by 1.6% to €37.1 billion. Sales rose by 1.1% in local currency. Like-for-like sales at METRO climbed by 0.5%. METRO Wholesale underwent particularly positive developments, while the sales of Real decreased after a difficult first half of the year.

At €12.0 billion, reported sales in Germany were 2.6% lower than in the previous year. Like-for-like sales decreased by 1.7%. Following a difficult first half of the year during which sales at METRO Wholesale and Real declined considerably, the trend improved significantly during the second half of the year.

The reported sales in the international business increased by 3.7% to €25.2 billion. This is especially due to the opening of new stores and the acquisition of Pro à Pro. Currency effects also played a part. International sales rose by 3.0% in local currency. Like-for-like sales increased by 1.6%. The international share of total sales stood at 67.8% (2015/16: 66.4%).

The reported sales in Western Europe (excl. Germany) increased by 3.6% to €10.5 billion. This is especially due to the acquisition of Pro à Pro. Like-for-like sales decreased slightly by 0.3%.

The reported sales in Eastern Europe increased by 4.5% to €10.3 billion. Especially positive currency effects in Russia influenced this development. Particularly positive sales trends were recorded in Turkey. Sales rose by 1.8% in local currency. Like-for-like sales increased by 2.3%.

The reported sales in Asia increased by 2.3%. All countries contributed to this positive development. Sales rose by as much as 4.2% in local currency. Like-for-like sales climbed by 4.7%.

Group sales of METRO 2016/17

by regions

|

|

|

|

|

|

Change in % compared with the previous year’s period |

|||||

|

|

2015/16 |

|

2016/17 |

|

in group currency (€) |

Currency effects in percentage points1 |

in local currency |

Like-for-like sales in local currency |

||

|

|||||||||||

METRO Wholesale |

|

29,000 |

|

29,866 |

|

3.0 |

0.7 |

2.3 |

0.9 |

||

Real |

|

7,478 |

|

7,247 |

|

−3.1 |

0.0 |

−3.1 |

−1.0 |

||

Others |

|

72 |

|

27 |

|

−62.4 |

−0.3 |

−62.1 |

– |

||

METRO |

|

36,549 |

|

37,140 |

|

1.6 |

0.5 |

1.1 |

0.5 |

||

thereof Germany |

|

12,279 |

|

11,962 |

|

−2.6 |

0.0 |

−2.6 |

−1.7 |

||

thereof international |

|

24,270 |

|

25,177 |

|

3.7 |

0.8 |

3.0 |

1.6 |

||

Western Europe (excl. Germany) |

|

10,173 |

|

10,543 |

|

3.6 |

0.0 |

3.6 |

−0.3 |

||

Eastern Europe |

|

9,828 |

|

10,266 |

|

4.5 |

2.7 |

1.8 |

2.3 |

||

Asia |

|

4,269 |

|

4,368 |

|

2.3 |

−1.9 |

4.2 |

4.7 |

||

|

|

EBIT1 |

|||

€ million |

|

2015/16 |

2016/17 |

||

|

|||||

METRO Wholesale |

|

1,048 |

1,114 |

||

Real |

|

105 |

80 |

||

Others |

|

−43 |

−86 |

||

Consolidation |

|

−5 |

−1 |

||

METRO |

|

1,106 |

1,106 |

||

The EBIT before special items amounted to €1,106 million, reaching the level of the previous year (2015/16: €1,106 million). This figure contains income from the sale of real estate amounting to €175 million (2015/16: €153 million). In 2016/17, the EBIT included 3 material real estate transactions, 2 of which in China (contributing approximately €110 million to the result) and 1 in Germany (approx. €40 million). Adjusted for positive currency effects of €37 million, EBIT before special items was €37 million lower than in the previous year.

Reported group EBIT totalled €852 million in financial year 2016/17 (2015/16: €1,219 million). This decrease was due in particular to income from the sale of the activities in Vietnam during the previous year (€446 million). Adjusted for the one-time income gained from the Vietnamese sale in the previous year, the special items are below the previous year’s level due to fewer restructuring activities.

€ million |

|

2015/16 |

|

2016/17 |

Earnings before interest and taxes EBIT |

|

1,219 |

|

852 |

Earnings share of non-operating companies recognised at equity |

|

3 |

|

0 |

Other investment result |

|

−3 |

|

−11 |

Interest income/expenses (interest result) |

|

−211 |

|

−156 |

Other financial result |

|

−114 |

|

−37 |

Financial result |

|

−325 |

|

−204 |

Earnings before taxes EBT |

|

894 |

|

649 |

Income taxes |

|

−375 |

|

−304 |

Profit or loss for the period |

|

519 |

|

345 |

Financial result

The net financial result primarily comprises the interest result of €−156 million (2015/16: €−211 million) and the other financial result of €−37 million (2015/16: €−114 million). The interest result improved thanks, in particular, to the lower level of interest. The €77 million improvement in the other financial result is mainly due to negative effects from the deconsolidation of METRO Cash & Carry Vietnam in the previous year and lower negative negative currency effects in the reporting period, primarily from Kazakhstan. In the decreased other investment result, the change mainly reflects the amortisation of the shares in real,- Digital Payment & Technology Services GmbH.

Taxes

The reported income tax expenses of €304 million (2015/16: €375 million) are €71 million lower than in the previous year and essentially concern deferred taxes.

The group tax rate in the reporting period amounted to 46.9% (2015/16: 42.0%). The comparatively low tax rate of the previous year is mainly due to the sale of METRO Cash & Carry Vietnam. Before special items, the tax rate amounted to 34.9% (2015/16: 38.7%). Adjusted for deferred tax income from the reversal of deferred tax liabilities in connection with the reallocation of goodwill, the tax rate before special items in the reporting period was 39.8%. The group tax rate represents the relationship between recognised income tax expenses and earnings before taxes.

Profit or loss for the period and earnings per share

Profit for the period in financial year 2016/17 totalled €345 million, a decline of €174 million compared with the previous year’s figure (2015/16: €519 million).

Net of non-controlling interests, profit for the period attributable to the shareholders of METRO AG totalled €325 million (2015/16: €506 million). This corresponds to a decline of €181 million.

In financial year 2016/17, METRO recorded earnings per share of €0.89 (2015/16: €1.39). The calculation was based on a weighted number of 363,097,253 shares. Profit for the period attributable to the shareholders of METRO AG of €325 million was distributed according to this number of shares. There was no dilution from so-called potential shares in financial year 2016/17 or in the previous year.

At €1.55, earnings per share before special items are €0.22 higher than in the previous year (2015/16: €1.33). This result forms the basis for the dividend recommendation.

|

|

|

|

|

|

|

|

Change |

|||||

|

|

|

|

2015/16 |

|

2016/17 |

|

absolute |

% |

||||

|

|||||||||||||

Profit or loss for the period |

|

€ million |

|

519 |

|

345 |

|

−174 |

−33.5 |

||||

Profit or loss for the period attributable to non-controlling interests |

|

€ million |

|

13 |

|

20 |

|

7 |

53.9 |

||||

Profit or loss for the period attributable to the shareholders of METRO AG |

|

€ million |

|

506 |

|

325 |

|

−181 |

−35.8 |

||||

Earnings per share (basic = diluted)1 |

|

€ |

|

1.392 |

|

0.89 |

|

−0.50 |

−36.0 |

||||

Earnings per share before special items1 |

|

€ |

|

1.332 |

|

1.55 |

|

0.22 |

16.5 |

||||

Liquidity (cash flow statement)

METRO’s liquidity is derivated on the basis of the cash flow statement. The cash flow statement serves to calculate and display the cash flows that METRO generated or employed during the financial year from operating, investing and financing activities. In addition, it shows the changes in cash and cash equivalents between the beginning and end of the financial year.

Cash inflow from operating activities in financial year 2016/17 amounted to €1,027 million (2015/16: €+1,173 million). Investing activities led to cash outflow of €601 million (2015/16: €+512 million). Compared with the previous year’s period, this represents a decrease in cash flow before financing activities of €1,259 million to €426 million. Cash outflow from financing activities totalled €438 million (2015/16: €−3,513 million).

- For more information, see the Annual Report 2016/17 at www.metroag.de/more/earnings-position.