METRO Wholesale

The METRO Wholesale segment comprises both the stationary business (METRO Cash & Carry) and the delivery business (food service distribution).

METRO Cash & Carry is one of the leading international wholesale traders and operates 759 wholesale stores under the METRO and MAKRO brands across 25 countries in Europe and Asia. Its more than 21 million commercial customers worldwide are mainly hotels, restaurants, catering companies, independent retailers as well as service providers and authorities, to which the company offers a portfolio of products and solutions that has been tailored to their specific requirements.

In the area of food service distribution (FSD), METRO maintains a strong international presence with its METRO Delivery Service and the specialist companies Classic Fine Foods, Pro à Pro and Rungis Express. Classic Fine Foods is an Asian fine-food delivery specialist. The company delivers products to premium customers, such as 5-star hotels and upmarket restaurants in Asia and the Middle East. Pro à Pro has been augmenting this area since February 2017. The company delivers products to commercial customers across France, in particular in the fields of corporate catering, canteens and system catering. Rungis Express is an important food delivery company in Germany that mainly caters to HoReCa customers.

METRO Wholesale

(previously METRO Cash & Carry)

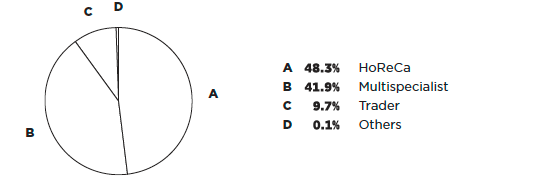

METRO Cash & Carry launched the New Operating Model in financial year 2015/16 to improve its business management. As part of the introduction of the New Operating Model, the METRO Cash & Carry countries were classified into the clusters HoReCa, Multispecialist, Trader and Others.

Supported by positive currency effects among other factors, METRO Wholesale’s reported sales for financial year 2016/17 increased by 3.0% to €29.9 billion. Since its acquisition in February 2017, Pro à Pro also contributed to the overall sales revenue with approximately €470 million. The company is one of the leading food service distribution providers (FSD) in France. Sales rose by 2.3% in local currency. Like-for-like sales increased by 0.9%. Like-for-like sales increased in all quarters and have now risen in every quarter for 4 years in a row.

The delivery business of METRO Wholesale continued to develop highly dynamically. Sales in financial year 2016/17 rose by more than 25% to more than €4.6 billion. The share of sales attributable to the delivery business for the entire year amounts to 15.6%. The acquisition of Pro à Pro has also contributed to this.

Sales of METRO Wholesale 2016/17

by clusters

Reported sales in the HoReCa cluster rose by 3.1% in financial year 2016/17. Sales rose by 4.5% in local currency. Like-for-like sales increased slightly by 0.3%. Especially Turkey contributed to the growth in like-for-like sales, while Germany recorded a decline.

In the Multispecialist cluster, sales increased by 3.7% in financial year 2016/17. Sales rose by 0.5% in local currency. Like-for-like sales slightly increased by 0.5%. Russia and the Netherlands recorded declining sales, in particular, while China, Pakistan and India achieved significant increases.

In the Trader cluster, sales increased by 3.3% in financial year 2016/17. Measured in local currency, sales in the Trader cluster rose by 3.9%. Sales rose by as much as 5.5% like-for-like. With the exception of Poland, like-for-like sales climbed in all countries.

EBIT before special items amounted to €1,114 million (2015/16: €1,048 million), supported by positive currency effects amounting to €37 million. Adjusted for these effects, EBIT before special items improved by €29 million. This particularly includes 2 real estate transactions in China, which contributed approximately €80 million (Q2) and €30 million (Q4) to the result. In the previous year, material real estate transactions only accounted for €34 million. Before these real estate transactions and currency effects, EBIT before special items amounted to €47 million less than the previous year. This decline is in particular attributable to developments in Russia, the Netherlands and Belgium, which could not be offset by earnings improvements in most of the other METRO Cash & Carry companies.

EBIT at METRO Wholesale totalled €1,035 million in financial year 2016/17 (2015/16: €1,271 million). This decrease was due in particular to income from the sale of the activities in Vietnam during the previous year (€446 million). Adjusted for the one-time income gained from the Vietnamese sale in the previous year, the special items are considerably below the previous year’s level due to fewer restructuring activities.

On 30 September 2017, METRO Wholesale operated 759 stores located in 25 countries. Of these stores, 104 were in Germany, 239 in Western Europe (excluding Germany), 283 in Eastern Europe and 133 in Asia. Additional countries were covered by the activities of Classic Fine Foods and Rungis Express. Overall, METRO Wholesale has operations in 35 countries.

- For more information, see the Annual Report 2016/17 at www.metroag.de/more/earnings-position.

|

|

|

|

|

|

Change in % compared with the previous year’s period |

|||||||||

|

|

2015/16 |

|

2016/17 |

|

in group currency (€) |

Currency effects in percentage points1 |

in local currency |

like-for-like sales in local currency |

||||||

|

|||||||||||||||

Sales |

|

29,000 |

|

29,866 |

|

3.0 |

0.7 |

2.3 |

0.9 |

||||||

HoReCa |

|

13,993 |

|

14,429 |

|

3.1 |

−1.4 |

4.5 |

0.3 |

||||||

Multispecialist |

|

12,066 |

|

12,518 |

|

3.7 |

3.3 |

0.5 |

0.5 |

||||||

Trader |

|

2,802 |

|

2,895 |

|

3.3 |

−0.5 |

3.9 |

5.5 |

||||||

Others |

|

138 |

|

23 |

|

– |

– |

– |

– |

||||||

EBIT2 |

|

1,048 |

|

1,114 |

|

– |

– |

– |

– |

||||||

EBIT margin (%)3 |

|

3.6 |

|

3.7 |

|

– |

– |

– |

– |

||||||

Locations (number) |

|

752 |

|

759 |

|

– |

– |

– |

– |

||||||

Selling space (1,000 m2) |

|

5,380 |

|

5,307 |

|

– |

– |

– |

– |

||||||

Since financial year 2015/16, the Trader cluster comprises the METRO Cash & Carry countries Moldova, Poland, Romania and Ukraine. The HoReCa, Multispecialist and Trader clusters replace the previous reporting regions of Germany, Western Europe, Eastern Europe and Asia.

Since financial year 2015/16, the Trader cluster comprises the METRO Cash & Carry countries Moldova, Poland, Romania and Ukraine. The HoReCa, Multispecialist and Trader clusters replace the previous reporting regions of Germany, Western Europe, Eastern Europe and Asia.