Application of new accounting methods

Accounting standards applied for the first time in financial year 2016/17

The following accounting standards and interpretations revised, amended and newly adopted by the International Accounting Standards Board (IASB) that were binding for METRO AG in financial year 2016/17 were applied for the first time in these consolidated financial statements unless the company opted for voluntary early adoption:

IAS 1 (Presentation of Financial Statements)

In the context of the Disclosure Initiative, the following amendments to IAS 1 (Presentation of Financial Statements) were made with respect to the materiality principle, the presentation of the asset position, the income statement or other comprehensive income as well as disclosures in the notes to the financial statements.

In accordance with the materiality principle, information should not be obscured by aggregating information, materiality considerations apply to all parts of a financial statement and the materiality principle is still valid even when a standard requires a specific disclosure.

For one, the changes take into consideration that the list of line items to be presented in the financial statements can be disaggregated and aggregated as relevant and include additional guidance on subtotals in these statements. On the other hand, an entity’s share of other comprehensive income as a group of equity-accounted associates and joint ventures is presented in aggregate using the equity method within the comprehensive income of the group based on whether or not it will subsequently be reclassified to profit or loss. The shares in other comprehensive income of associates or joint ventures are immaterial and are therefore not shown separately.

Moreover, comprehensibility and comparability should be considered when determining the order of the notes.

The above changes have only a minor influence on the disclosures in the consolidated financial statements of METRO AG.

Additional IFRS amendments

The annual improvements to IFRS 2012–2014 comprise, among others, a clarification in IAS 34 (Interim Financial Reporting) regarding the disclosure of information “elsewhere in the interim financial report”.

In addition, as part of the improvements, 2 clarifications were made in IFRS 5 (Non-current Assets Held for Sale and Discontinued Operations). If an entity reclassifies an asset (or disposal group) from “held for sale” to “held for distribution” and with this an entity moves from one method of disposal to the other without interruption, this reclassification is seen as a continuation of the original plan of sale. As a result, the entity can continue to apply the accounting requirements applicable to assets (or disposal groups) that are classified as held for sale. The same applies to reclassifications from the category “held for distribution” to the category “held for sale”. The reclassification does not result in an extension of the period in which the sale or distribution must be completed.

Assets (or disposal groups) that no longer satisfy the criteria for recognition as held for distribution must be treated in the same way as an asset that is no longer recognised as held for sale and must no longer be recognised in accordance with IFRS 5.

Other accounting rules to be applied for the first time in financial year 2016/17 without material effects on METRO are:

- IFRS 10/IFRS 12/IAS 28 (Amendment: Investment Entities: Applying the Consolidation Exception)

- IFRS 11 (Amendment: Accounting for Acquisitions of Interests in Joint Operations)

- IAS 16/IAS 41 (Change: Amendment: Agriculture Bearer Plants)

- IAS 16/IAS 38 (Amendment: Clarification of Acceptable Methods of Depreciation and Amortisation)

- IAS 27 (Amendment: Equity Method in Separate Financial Statements)

Accounting standards that were published but not yet applied in financial year 2016/17

A number of other accounting standards and interpretations newly adopted or revised by the IASB were not yet applied by METRO AG in financial year 2016/17 because they were either not yet mandatory or have not yet been endorsed by the European Commission.

Standard/ |

|

Title |

|

Effective date according to IFRS1 |

|

Application at METRO AG from2 |

|

Endorsed by EU3 |

||||||||

|

||||||||||||||||

Amendments to IFRS 1 |

|

Amendments as a result of the annual improvements cycle 2014–2016 (deletion of temporary exemptions) |

|

1/1/2018 |

|

1/10/2018 |

|

No |

||||||||

Amendments to IFRS 2 |

|

Share-based Payment (Amendment: Classification and Measurement of Share-based Payment Transactions) |

|

1/1/2018 |

|

1/10/2018 |

|

No |

||||||||

Amendments to IFRS 4 |

|

Insurance Contracts (Amendment: Applying IFRS 9 Financial Instruments with IFRS 4 Insurance Contracts) |

|

1/1/2018 |

|

1/10/2018 |

|

Yes |

||||||||

IFRS 9 |

|

Financial Instruments |

|

1/1/2018 |

|

1/10/2018 |

|

Yes |

||||||||

Amendments to IFRS 10/IAS 28 |

|

Consolidated Financial Statements/Investments in Associates and Joint Ventures (Amendment: Sale or Contribution of Assets between an Investor and its Associate or Joint Venture) |

|

unknown4 |

|

unknown4 |

|

No |

||||||||

Amendments to IFRS 12 |

|

Amendments as a result of the annual improvements cycle 2014–2016 (clarification of the application area) |

|

1/1/2017 |

|

1/10/2017 |

|

No |

||||||||

IFRS 15 |

|

Revenue from Contracts with Customers |

|

1/1/2018 |

|

1/10/2018 |

|

Yes |

||||||||

Amendments to IFRS 15 |

|

Clarifications to IFRS 15 “Revenue from Contracts with Customers” |

|

1/1/2018 |

|

1/10/2018 |

|

Yes |

||||||||

IFRS 16 |

|

Leases |

|

1/1/2019 |

|

1/10/2019 |

|

Yes |

||||||||

IFRS 17 |

|

Insurance contracts |

|

1/1/2021 |

|

1/10/2021 |

|

No |

||||||||

Amendments to IAS 7 |

|

Statement of Cash Flows (Amendment: Disclosure Initiative) |

|

1/1/2017 |

|

1/10/2017 |

|

Yes |

||||||||

Amendments to IAS 12 |

|

Income Taxes (Amendment: Recognition of Deferred Tax Assets for Unrealised Losses) |

|

1/1/2017 |

|

1/10/2017 |

|

Yes |

||||||||

Amendments to IAS 28 |

|

Amendments as a result of the annual improvements cycle 2014–2016 (clarification on the right to vote in specific cases at fair value) |

|

1/1/2018 |

|

1/10/2018 |

|

No |

||||||||

Amendments to IAS 40 |

|

Investment properties (Amendment: Transfer of Investment Property) |

|

1/1/2018 |

|

1/10/2018 |

|

No |

||||||||

IFRIC 22 |

|

Foreign Currency Transactions and Advance Consideration |

|

1/1/2018 |

|

1/10/2018 |

|

No |

||||||||

IFRIC 23 |

|

Uncertainty over Income Tax Treatments |

|

1/1/2019 |

|

1/10/2019 |

|

No |

||||||||

IFRS 2 (Share-based Payment)

The amendment Classification and Measurement of Share-based Payment Transactions relates to 3 aspects of IFRS 2.

Until now, IFRS 2 contained no guidance on how vesting conditions affect the fair value of liabilities for cash-settled share-based payments. IASB has now added guidance that introduces accounting requirements for cash-settled share-based payments that follow the same approach as used for equity-settled share-based payments. As a result, market performance conditions and non-service conditions must be considered in fair value, while service conditions and other performance conditions must be considered in the quantity of instruments.

In addition, an exception has been introduced so that a share-based payment where the entity settles the share-based payment arrangement net is classified as equity-settled in its entirety, provided the share-based payments would have been classified as equity-settled had it not included the net settlement feature.

Moreover, it has been clarified that where a cash-settled share-based payment changes to an equity-settled share-based payment because of modifications of the terms and conditions, the original liability recognised in respect of the cash-settled share-based payment is derecognised and the equity-settled share-based payment is recognised at the modification date’s fair value to the extent services have been rendered up to the modification date. Any difference between the carrying amount of the liability and the amount recognised in equity is to be recognised in profit or loss immediately.

These amendments to IFRS 2 apply to financial years beginning on or after 1 January 2018. Subject to the respective EU endorsement, METRO AG will apply these regulations for the first time on 1 October 2018. These changes will be applied prospectively to any relevant transactions of METRO AG.

IFRS 9 (Financial Instruments)

The new IFRS 9 (Financial Instruments) will replace IAS 39 (Financial Instruments: Recognition and Measurement), covering the classification and measurement of financial instruments.

Financial instruments are recognised when the company preparing the financial statements becomes a contractual partner and thus has acquired the rights of the financial instrument or assumed comparable obligations. As a rule, the initial measurement of financial assets and liabilities is at fair value adjusted for transaction costs, if applicable. Only trade receivables without a significant financing component are recognised at the transaction price.

At the time of recognition, regulations for classification are to be taken into account. According to IAS 39, the subsequent measurement of a financial asset and a financial liability is linked to their classification. Financial assets are classified on the basis of the characteristics of contractual cash flow of the financial asset and the business model which the entity uses to manage the financial asset. The original 4 measurement categories for financial assets were reduced to 2 categories: financial assets recognised at amortised cost (category 1) and financial assets measured at fair value (category 2), wherein the latter category has 2 subcategories.

If the financial asset (debt instruments) is held within a business model whose objective is collecting payments such as principal and interest, and if the contract terms stipulate certain payments are exclusively for principal and interest, this financial instrument shall in principle be recognised at amortised cost (category 1). If the objective of the business model is collecting payments and selling financial assets (debt instruments), and if the payment dates are fixed, the changes in its fair value are recognised in other comprehensive income outside of profit or loss (subcategory 2 a). If these criteria are not cumulatively met, the financial asset is measured at fair value through profit or loss (subcategory 2 b). Amortised cost is determined using the effective interest method, while IFRS 13 (Fair Value Measurement) is applied to determine fair value measurement.

As a rule, equity instruments are classified as subcategory 2 b based on the classification criteria stated above. However, an irrevocable election can be made for equity instruments upon initial recognition to classify them as subcategory 2 a. Furthermore, all debt instruments not recognised at fair value through profit or loss may be classified as subcategory 2 b when doing so eliminates or significantly reduces a measurement or recognition inconsistency (fair value option).

In general, financial liabilities are measured at amortised cost (category 1). In some cases, however, such as with financial liabilities held for trading, fair value measurement through profit or loss is required (subcategory 2 b). Here, too, an entity may elect to apply the fair value option, that is, the measurement at fair value through profit or loss. In contrast to financial assets, financial liabilities can include embedded derivatives that are required to be separated. If separation is required, the host contract is usually measured according to the rules of category 1 and the derivative according to the rules of subcategory 2 b.

Unlike IAS 39 (which uses the incurred loss model), IFRS 9 focuses on expected losses. This expected loss model uses a 3-stage approach for recognising impairment. At the first stage, impairment losses are recognised in the amount of the losses resulting from default on the financial instrument expected in the next 12 months. At stage 2, the expected credit losses that result from all possible default events over the expected life of the financial instrument must be recognised. Calculation at this stage is based on a portfolio of similar instruments. Financial instruments are reclassified from the first to the second stage when the default risk since initial recognition has increased significantly and exceeds a minimum default risk. At the third and final stage, impairment losses are recognised for additional objective indications with respect to the individual financial instrument.

A simplified approach based on the expected loss throughout the lifetime (similar to stage 2) can be applied to trade receivables, certain leasing receivables and contract assets as well as in certain other cases.

In order to reduce the complexity and make hedge accounting more comprehensible on the balance sheet, the following key changes were made. The scope of possible hedged items was expanded. For example, several risk positions can now be more easily combined into a single hedged item and hedged. The net position can be designated as the hedged item if the risks partially offset each other in the combined risk position. In addition, non-derivative financial instruments classified as subcategory 2 b can be designated as hedging instruments. Furthermore, thresholds are no longer stipulated for measuring effectiveness. Effectiveness is assessed in reference to the economic relationship between the hedged item and hedging transaction, taking into account the hedging ratio and default risk.

IFRS 9 applies to financial years beginning on or after 1 January 2018. METRO AG will thus apply these guidelines for the first time on 1 October 2018. As part of a project dealing with the introduction of IFRS 9 at METRO AG, the following qualitative effects of the new standard were analysed over the course of financial year 2016/17. METRO AG has not yet completed the detailed analysis of IFRS 9, which means that the effects on the financial statements may not be clearly foreseeable for its first application.

Shares in money market funds will for the most part be accounted for at fair value through profit or loss. For the classification and measurement of debt instruments, METRO AG currently does not expect significant effects in terms of amount.

The extent to which effects from the fair value measurements of equity instruments will be material can not yet be estimated. Beyond that, the exercise of the option to recognise changes in fair value for equity instruments has not yet been decided.

The classification and measurement of financial liabilities is unlikely to change significantly.

The effect at the transition point from the first application of the expected credit loss model can not yet be reliably estimated at the moment. However, due to the short maturities and the high credit quality of the financial assets, this first-time application effect is considered to be relatively low. In the following years, the introduction of the impairment models could lead to a higher fluctuation in the income statement, since the level of risk provisions, in particular for trade receivables, also depends on economic conditions. METRO AG is currently assuming that the previous hedge accounting can continue.

During transitioning to the new classification and measurement methods and the new impairment model, METRO AG will not change the previous year's figures to IFRS 9 and therefore adjust the reserves retained from earnings as of October 1 2018 in order to capture the effects of the first-time application of the standard.

In order to ensure the presentation of the new notes, in particular with regard to credit risks and expected losses, system and reporting adjustments are expected to be required.

IFRS 10 (Consolidated Financial Statements) and IAS 28 (Investments in Associates and Joint Ventures)

A conflict exists between the current requirements of IFRS 10 (Consolidated Financial Statements) and IAS 28 (Investments in Associates and Joint Ventures) regarding the sale or contribution of assets between an investor and its associate or joint venture. IAS 28 requires a partial gain or loss recognition, limited to the unrelated investors’ interests in the investee, for all transactions between an investor and its associate or joint venture. IFRS 10, in contrast, requires that the gain or loss that arises on the loss of control of a subsidiary is recognised in full.

The amendment clarifies how to account for the gain or loss from transactions with associates or joint ventures, with the partial or full recognition requirement depending on whether or not the assets being sold or contributed are a business as defined in IFRS 3 (Business Combinations). IFRS 3 defines a business as an integrated set of activities that is required to have inputs and processes which together are used to create outputs.

If the sold or contributed asset classifies as a business, the gain or loss from the transaction must be recognised in full. In contrast, the gain or loss from the sale of assets that do not classify as a business to associates or joint ventures or their contribution to associates or joint ventures must be recognised only to the extent of the unrelated investors’ interests in the associate or joint venture.

If a group of assets is to be sold or contributed in separate transactions, the investor must assess whether this group of assets constitutes a single business and should be accounted for as a single transaction.

IASB has indefinitely deferred the original effective date of this amendment for financial years starting on or after 1 January 2016. As a result, the date of first-time application of this amendment at METRO AG is unknown. As METRO AG currently follows the rules of IFRS 10, future transactions will be impacted accordingly.

IFRS 15 (Revenue from Contracts with Customers)

The new IFRS 15 will replace IAS 18 (Revenue) and IAS 11 (Construction Contracts) and related interpretations and stipulates a uniform and comprehensive model for recognising revenue from customers.

The new standard uses a 5-step model to determine the amount of revenue and the date of realisation. In the first step, contracts with the customers are identified. According to IFRS 15, a contract is entered into by the contractual partners if the company can identify the rights of the customer to goods and services and the payment terms and if the agreement has economic substance. In addition, it must be probable that the company will collect the consideration. If a company has more than 1 contract with a single customer at (virtually) the same time, and if certain criteria are met, the contracts can be combined and treated as a single contract.

As a rule, a contract as defined in IFRS 15 can include several performance obligations. Therefore, possible separate performance obligations are identified within a single contract in the second step. A separate performance obligation is identified when a good or service is distinct. This is the case when the customer can use a good or service on its own or together with other readily available resources and it is separately identifiable from other commitments in the contract.

In the third step, the transaction price corresponding to the expected consideration is determined. The consideration may include fixed and variable components. For variable compensation, the expected amount is to be estimated carefully based on either the expected value or the most probable amount, depending on which amount best reflects the amount of consideration. In addition, the consideration includes the interest rate effect if the contract includes a financing component significant to the contract, the fair value of non-cash considerations and the effects of payments made to the customer such as rebates and coupons.

The allocation of the transaction price to separate performance obligations is carried out in the fourth step. In principle, the transaction price is to be allocated to the separately identified performance obligations in relation to the relative stand-alone selling price. Observable data must be used to determine the stand-alone selling price. If this is not possible, estimates are to be made. For this purpose, IFRS 15 suggests various methods for estimating according to which the estimates are based on market prices for similar services or expected costs plus a surcharge. In exceptional cases, the estimate can also be based on the residual value method.

In the fifth and final step, revenue is recognised at the point in time when the performance obligation is satisfied. The performance obligation is satisfied when the control of the good or service is transferred to the customer. The performance obligation can be satisfied at a point in time or over a period of time. If the performance obligation is satisfied over time, the revenue is recognised over the period in which the performance obligation is satisfied in a manner that best reflects the continuous transfer of control over time.

In addition to the 5-step model, IFRS 15 addresses various special topics such as the treatment of costs for obtaining and fulfilling a contract, presentation of contract assets and liabilities, rights of return, commission business, customer retention and customer loyalty programmes. In addition, the disclosures in the notes are significantly expanded. Accordingly, this includes qualitative and quantitative disclosures to be made in the future on contracts with customers, on significant estimates and judgements as well as changes over time.

IFRS 15 is to be applied for the first time to financial years beginning on or after 1 January 2018. The group does not make use of the option of early adoption of IFRS 15, but will apply the standard for the first time for financial year 2018/2019 beginning on 1 October 2018 (IFRS 15 transition year). METRO AG will apply the option of simplified first-time adoption, i.e. recognising the cumulative effects of the application of IFRS 15 on all contracts that were not yet fulfilled at the beginning of the reporting period as an adjustment to the opening balance of equity at the date of initial application without affecting net income. As a result, comparative figures from the prior-year periods are not adjusted but a reconciliation for financial year 2018/2019 between old regulations and IFRS 15 is presented to explain the changes in balance sheet and income statement items for the current period resulting from first-time adoption of IFRS 15.

The focus of the group-wide project for the introduction of IFRS 15 in financial year 2016/2017, which has been in progress since 2016, focused in particular on the identification of the qualitative IFRS 15 impacts of the largest Group companies. For the identified impacts, a materiality analysis will be carried out in the coming financial year in order to identify and quantify the key impacts to be implemented. Based on the results, the next step is to analyse the possible adjustment of processes and systems to ensure IFRS 15 compliant accounting for financial year 2018/2019. Based on the impact analysis that has been carried out so far, the group does not expect any significant change in the timing of revenue recognition or in the allocation of the transaction price between the individual performance obligations.

Based on the results of the analyses carried out in financial year 2016/2017, the following IFRS 15 impacts were basically determined:

As part of discount campaigns or customer loyalty programmes (for instance: gold and silvercards at METRO Cash & Carry Germany), the customer is regularly granted the option of acquiring additional goods or services at a discounted price in the future. Part of the transaction price can be allocated to the resulting essential right. In the future, sales will be accrued under contract liability. Revenue recognition for the essential right occurs at the time the right is redeemed or expired, potentially leading to a later recognition of revenue.

For certain business models, situations were identified where third parties are involved in performing obligations in contracts with customers (e.g. sushi counter, Tchibo, third-party vouchers, extended warranties). The acknowledgement of whether METRO AG acts as principal or agent in those matters must be reassessed based on the indicator changes in IFRS 15. The outcome of this assessment is decisive for the gross or net presentation of revenues. In this context, the accounting of commissions received should be particularly appreciated.

Sales in some METRO Cash & Carry business models regularly result in redemption or conversion rights. These may be legally binding or arise from active business practice. Refunds represent a form of variable consideration in the determination of the transaction price. The disclosure of the return obligations will in the future be made in the liabilities section under the item return liability. In addition, an asset is recognised for the company's right to recover products upon settlement of the return obligation (return asset).

Some METRO business models include multicomponent contracts, which allow customers to purchase subsidised products when the contract is signed. An example is the business model of the professional equipment supply of METRO Cash & Carry France. Customers receive a complete solution, from design through to delivery, installation and maintenance of restaurant facilities. In such cases, the total consideration of the contract shall be divided into the identifiable performance obligations in accordance with the relative individual selling prices and, in comparison to the previous accounting, a potentially larger part of the total compensation is attributable to previously subsidised component, so that in the future revenues for those products must be reported earlier. As a result, the balance sheet total asset at the time of initial application may increase due to in contract assets being activated. Legally, these represent receivables not yet incurred from the customer contract.

In some business models, METRO AG customers are granted volume discounts if predefined turnover thresholds are exceeded, which usually leads to subsequent price reductions (for example: reduction of the purchase price of kitchens in the “project business kitchens” for achieving certain minimum purchase quantities of METRO Cash & Carry products following the kitchen purchase). Those purchase price reductions are to be considered on the basis of an estimate when determining the transaction price as a variable consideration.

In the future, additional costs of obtaining a contract are to be capitalised under certain conditions and written off over the term of the contract or the average commitment period.

In the case of METRO AG, these costs can relate to, for example, incentivising sales employees in the form of commissions for the acquisition of new customers.

A clarification was released following the adoption of the new IFRS 15. It supplements the IFRS 15 regulations with respect to identifying performance obligations, principal versus agent considerations and the separation of licences. It also includes provisions for a simplified transition to IFRS 15.

The clarification to IFRS 15, which was adopted into EU law on 9 November 2017, will be effective for reporting periods beginning on or after 1 January 2018. The project dealing with the introduction of IFRS 15 at METRO AG will also consider the impact of the clarifications.

IFRS 16 (Leases)

The new standard IFRS 16 will replace the currently applicable standard IAS 17 (Leases) and IFRIC 4 (Determining Whether an Arrangement Contains a Lease). IFRS 16 generally applies to contracts that convey the right to use an asset, rental contracts and leases, subleases and sale-and-leaseback transactions. A lessee can elect to apply IFRS 16 to leases of certain intangible assets, whereas agreements on service concessions or leasing of natural resources are outside the scope of IFRS 16.

In contrast to IAS 17, the definition of a lease in IFRS 16 focuses on the concept of control. A lease exists when a contract conveys the right to control the use of an identified asset for a period of time in exchange for consideration.

The key change of IFRS 16 compared to IAS 17 concerns the lessee accounting model. Lessees no longer have to classify leases as operating or finance. Instead, the lessee recognises a right-of-use asset and a lease liability upon commencement of the lease when the lessor makes an underlying asset available for use by the lessee.

The lessee measures the lease liability at the present value of the lease payments payable over the lease term. The lease payments include all fixed payments less any lease incentives for the conclusion of the contract. This includes all index-based variable lease payments. In addition, the lease payments must include any variable lease payments that classify as in-substance fixed payments as well as amounts expected to be payable by the lessee under residual value guarantees. The exercise price of a purchase or lease extension option must be included if the lessee is reasonably certain to exercise that option. In addition, the lease payments must include payments of penalties for terminating the lease if the lease term reflects the lessee exercising an option to terminate the lease.

Measurement must be based on the interest rate implicit in the lease. If the lessee is unable to determine this interest rate, the lessee’s incremental borrowing rate may be applied. Over the term of the lease, the lease liability is accounted for under the effective interest method in consideration of lease payments made. Changes in the calculation parameters, such as changes in the lease term, a reassessment of the likelihood that a purchase option will be exercised or expected lease payments, require a remeasurement of the liability.

The simultaneously recognised right-of-use asset is capitalised at the amount of the liability adjusted for lease payments made and directly attributable costs. Any payments received from the lessor that are related to the lease are deducted. Measurement also considers any reinstatement obligations from leases.

After initial recognition, the right-of-use asset can be measured at amortised cost or using the revaluation method, respectively, under IAS 16 (Property, Plant and Equipment) or IAS 40 (Investment Property). When applying the amortised cost model, the right-of-use asset is depreciated over the shorter period lease term or its useful life. If it is reasonably certain upon commencement of the lease that ownership of the asset will pass to the lessee at the end of the lease, the right-of-use asset is depreciated over the economic life of the underlying asset. IAS 36 (Impairment of Assets) must be considered.

Correspondingly, a remeasurement of the lease liability to reflect changes in lease payments leads to an adjustment of the right-of-use asset outside of profit or loss. Any negative adjustments exceeding the carrying amount must be recognised through profit or loss.

Lessees can elect to make use of several policy options. For accounting and measurement, they have the option to build a portfolio of leases with similar characteristics. In addition, they may elect not to apply the right-of-use approach to short-term leases (with a maximum term of 12 months) and so-called low-value assets. Low-value assets are a component of leases that, individually, are not material to the business. If a lessee elects to make use of this policy option, the lease is recognised in accordance with the previously applicable IAS 17 regulations on operating leases.

In the future, comprehensive qualitative and quantitative information must be provided in the notes to the financial statements.

The revised definition of leases also applies to the lessor and can lead to assessments deviating from IAS 17. However, the lessor continues to classify a lease as either an operating lease or a finance lease. Except for sale-and-leaseback transactions, IFRS 16 does not result in any material changes for lessors.

In the case of sale-and-leaseback transactions, the sold entity must first apply the requirements of IFRS 15 to determine whether a sale has actually occurred. If the transfer is classified as a sale in accordance with IFRS 15, the seller/lessee measures a right-of-use asset arising from the leaseback as the proportion of the previous carrying amount of the asset that relates to the right of use retained. The gain (or loss) that the seller/lessee recognises is limited to the proportion of the total gain (or loss) that relates to the rights transferred to the buyer/lessor. If the transfer is not a sale, the transaction is treated like a financing transaction without a disposal of the asset.

IFRS 16 is applicable for reporting periods beginning on or after 1 January 2019.

METRO AG will apply these regulations for the first time on 1 October 2019, and thus refrains from early application of the standard together with IFRS 15 on 1 October 2018. As part of a group-wide changeover project for the introduction of IFRS 16, METRO AG has already analysed the effects of IFRS 16 during the past financial year 2016/17 (“impact analysis”).

The new leasing standard IFRS 16 has a significant impact on the true and fair view of the asset, financial and earnings position of METRO AG.

While future payment obligations for operating leases had previously only been disclosed in the notes, the resulting rights and payment obligations are to be accounted for in future as rights of use and lease liabilities. This mainly affects the leasing of real estate.

METRO AG expects a significant increase in total assets at the time of initial application in the amount of €3 to €4 billion due to the increase in fixed assets based on the addition of the right of use to be capitalised depending on the selected conversion method. The modified retroactive approach with the option of applying the right of use in the amount of the lease liability will not apply according to the current state of affairs.

Additional impairment losses and interest expenses will be recognised in the income statement in the future instead of leasing expenses. This leads to an improvement in EBIT at the expense of the financial result of a low 3-digit million euros amount.

In the impact analysis, the modified standard method is used to calculate the effects on the financial ratios. The right of use of the leased asset is measured at its carrying amount as if the standard had been applied since the beginning of the lease, but discounted using the marginal interest expense on borrowings at the time of first-time adoption. Meanwhile, the lease liability is measured at the present value of the remaining lease payments using the marginal interest expense on borrowings at the time of first-time adoption. The cumulative effect of this is recognised in reserves retained from earnings. A decision as to which transitional method is applied, entirely retroactively or retroactively modified, has not yet been reached by METRO AG.

METRO AG will exercise the option of not applying the right-of-use approach to low-value assets (mainly business and office equipment) and short-term leases (maximum terms of 12 months). Rental expenses for these assets must therefore be recognised directly in the income statement.

Exercising the option to separate lease and non-lease components (service) in a contract has not yet been decided.

IAS 7 (Statement of Cash Flows)

The amendments to IAS 7 in the context of the Disclosure Initiative will require entities to provide disclosures on the following changes in liabilities arising from financing activities: changes from financing cash flows, changes arising from obtaining or losing control of subsidiaries or other businesses, the effect of changes in foreign exchange rates, changes in fair values and other changes. Financial liabilities are defined as liabilities for which cash flows were, or future cash flows will be, classified in the statement of cash flows as cash flows from financing activities.

In addition, the amendments state that changes in financial liabilities must be disclosed separately from changes in other assets and liabilities.

These amendments to IAS 7 apply to financial years beginning on or after 1 January 2017. METRO AG will apply these regulations for the first time on 1 October 2017 and extend its disclosures accordingly.

Additional IFRS amendments

At this point, the first-time application of the other standards and interpretations listed in the table as well as of other standards revised as part of the annual improvements is not expected to have a material impact on the group’s asset, financial and earnings position.

Segment reporting

As of 12 July 2017, the wholesale and food retail business, and hence the reporting segments METRO Cash & Carry and Real (including other related real estate and holding activities), was separated from the current CECONOMY AG. As a result, changes were made to segment reporting. Please refer to the comments on the demerger and segment reporting.

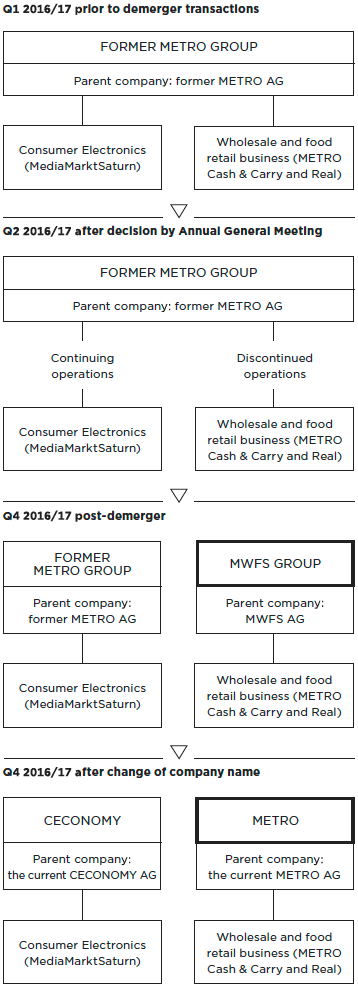

Demerger of the former METRO GROUP

The demerger of the former METRO GROUP into 2 legally independent listed companies was announced in March 2016 and finalised during the course of financial year 2016/17. Initially, the wholesale and food retail business including real estate as well as the associated management and service activities were transferred from the former METRO AG to METRO Wholesale & Food Specialist AG (hereinafter: MWFS AG). The consumer electronics business unit remained in the former METRO AG. Following the demerger, the former METRO AG changed its name to CECONOMY AG. In turn, MWFS AG changed its name to METRO AG.

In order to clarify the relationships before and after the demerger, the following diagram shows the individual steps in the demerger in a simplified form:

Definition of terms for METRO

Following the resolution and approval by the Annual General Meeting of the former METRO AG on the demerger agreement on February 6 2017, the MWFS business unit was reported separately in the consolidated balance sheet of the former METRO AG pursuant to IFRS 5 (Non-current Assets Held for Sale and Discontinued Operations) as a discontinued operation until the spin off took effect. As of this date, the individual assets and liabilities of the MWFS division in the consolidated balance sheet of the former METRO AG were not further amortised and measured at the lower carrying amount and fair value less costs to sell.

In the present financial statements of the new METRO AG, the previous year’s figures as of 30 September 2016 correspond to those reported in the combined financial statements of the MWFS GROUP. The previous year's income statement and cash flow statement figures also correspond to those of the combined financial statements.

MWFS AG changed its name to METRO AG on 18 August 2017.